ETF Meaning

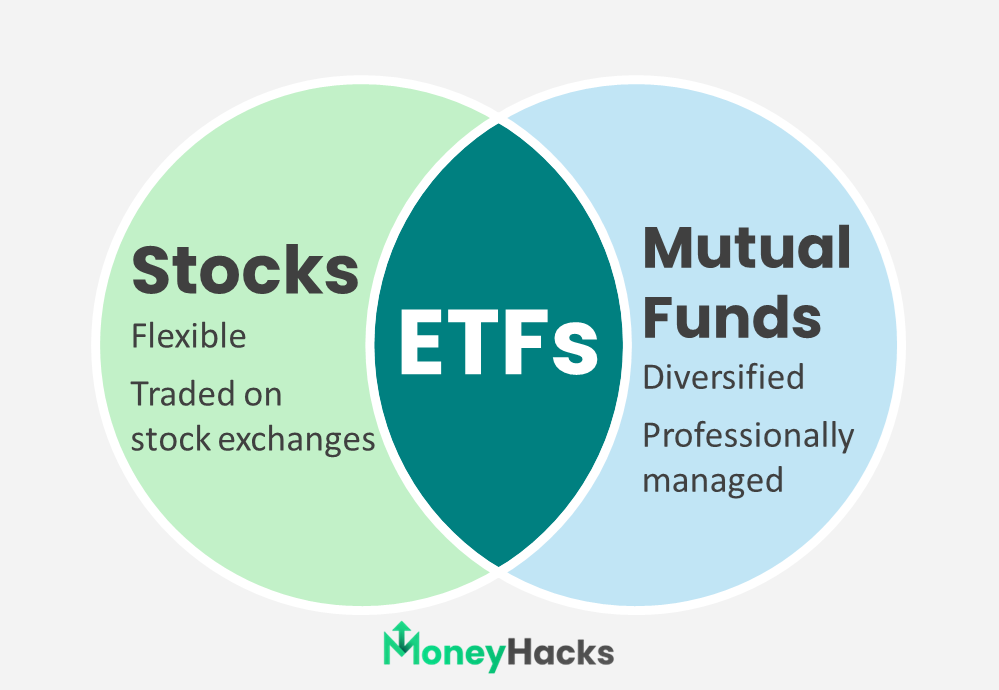

An Exchange-Traded Fund (ETF) is a type of investment that combines the diversification benefits of mutual funds with the flexibility and trading features of individual equities. ETFs are like baskets that hold various assets such as stocks, bonds, or commodities, allowing investors to buy shares representing a portion of that basket. These shares can be traded on stock exchanges throughout the trading day, providing investors with easy access to diversified portfolios and often lower fees compared to mutual funds.

Types of ETFs

There are several types of ETFs, each designed to meet different investment objectives and preferences:

- Equity ETFs: These ETFs invest primarily in stocks or shares of companies. They can focus on specific sectors, industries, regions, or market capitalization sizes (such as large-cap, mid-cap, or small-cap).

- Bond ETFs: Bond ETFs invest in fixed-income securities like government bonds, corporate bonds, municipal bonds, or high-yield bonds. They expose the bond market while offering diversification and potentially steady income.

- Commodity ETFs: Commodity ETFs track the prices of physical commodities like gold, silver, oil, or agricultural products. Investors can gain exposure to commodity markets without owning the physical assets.

- Sector and Industry ETFs: These ETFs concentrate on specific sectors or industries of the economy, such as technology, healthcare, energy, or financial services. They allow investors to target their investments in areas they believe will perform well.

- International ETFs: International ETFs invest in stocks or bonds of companies or governments outside the investor’s home country. They provide exposure to global markets and can help diversify a portfolio beyond domestic securities.

- Style ETFs: Style ETFs follow specific investment styles or strategies, such as growth, value, or dividend investing. They aim to replicate the performance of indices that focus on particular investment characteristics.

- Smart Beta ETFs: These ETFs combine elements of passive and active investing by using alternative index construction methodologies to potentially outperform traditional market-capitalization-weighted indices.

- Thematic ETFs: Thematic ETFs invest in companies related to specific themes or trends, such as clean energy, cybersecurity, artificial intelligence, or robotics.

- Inverse ETFs: Inverse ETFs use derivatives to profit from a decline in the value of an underlying index or asset. They are designed to move in the opposite direction of the benchmark they track.

- Leveraged ETFs: Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index or asset. They aim to provide multiples of the daily returns of the index they track, often with higher risk and volatility.

Advantages of Investing in ETFs

Investing in ETFs comes with several advantages, such as:

- Diversification: ETFs offer instant diversification by holding a basket of assets within a single investment, reducing the risk associated with investing in individual stocks or bonds.

- Liquidity: ETFs are traded on stock exchanges throughout the trading day, providing investors with easy access to buy or sell shares at market prices, unlike traditional mutual funds which are only traded once per day at the fund’s closing price.

- Low Costs: ETFs typically have lower expense ratios compared to traditional mutual funds, making them cost-effective investment options for investors seeking to minimize fees.

- Transparency: Most ETFs disclose their holdings on a daily basis, allowing investors to know exactly what assets they own within the fund at any given time.

- Flexibility: ETFs can be bought or sold in real-time during market hours, providing investors with flexibility in managing their investment portfolios and implementing various trading strategies.

Disadvantages of Investing in ETFs

While ETFs offer many benefits, they also come with risks:

- Brokerage Commissions: While many brokers offer commission-free ETF trading, investors may still incur brokerage commissions when buying or selling ETF shares, which can erode returns, particularly for frequent traders.

- Bid-Ask Spreads: ETFs trade on stock exchanges like individual stocks, and as a result, they are subject to bid-ask spreads. This difference between the buying (ask) and selling (bid) prices can impact the cost of trading ETF shares.

- Tracking Error: Some ETFs may experience tracking error, which is the discrepancy between the ETF’s performance and the performance of its underlying index. This can occur due to factors such as management fees, trading costs, and sampling methods.

- Market Risk: Like any investment, ETFs are subject to market risk, including the potential for loss of principal value due to fluctuations in the prices of the underlying assets held by the fund.

Bottom Line

In conclusion, Exchange-Traded Funds (ETFs) offer investors a versatile and cost-effective way to access diversified portfolios of assets, including stocks, bonds, commodities, and more. With a wide range of types catering to various investment strategies and preferences, ETFs provide liquidity, transparency, and potential cost savings compared to traditional mutual funds. However, investors should carefully consider the advantages and disadvantages of ETF investing, such as liquidity risks, tracking errors, and associated costs, before incorporating them into their investment portfolios. By conducting thorough research, diversifying effectively, and staying disciplined in their investment approach, investors can harness the benefits of ETFs to pursue their financial goals while managing risks effectively in the dynamic world of investing.